Ev Vehicles 2024 Tax Credit. Other important things about the ev tax credit. How do you claim the ev tax credit?

The rules why does the ev tax credit keep changing? And if you thought you finally understood how the ev tax credit works, look again.

Not Have Claimed Another Used Clean Vehicle Credit In The 3 Years.

That's because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there's a tax credit for you too.

The Ev Tax Credit Is Based On The Date Placed In Service, Usually The Day You Take Delivery Of The Car, Not The Order.

And if you thought you finally understood how the ev tax credit works, look again.

It's Worth 30% Of The Sales Price,.

Images References :

Source: www.autopromag.com

Source: www.autopromag.com

Here are the cars eligible for the 7,500 EV tax credit in the, If you had no tax liability, you got bupkis, which means those who needed the. Individuals who entered into a written binding contract to purchase a new qualifying electric vehicle before august 16, 2022, but do not take possession of the.

Source: nydiaqlettie.pages.dev

Source: nydiaqlettie.pages.dev

2024 Honda Electric Suv Olwen Aubrette, Individuals who entered into a written binding contract to purchase a new qualifying electric vehicle before august 16, 2022, but do not take possession of the. The r1s starts price of $76,700, and.

Source: grist.org

Source: grist.org

The EV tax credit can save you thousands if you’re rich enough Grist, Rivian's first attempt at an suv skims just under the maximum msrp threshold to be eligible for the full $7500 tax credit. Visit fueleconomy.gov for a list of qualified vehicles.

Source: www.motorbiscuit.com

Source: www.motorbiscuit.com

2024 Chevy Blazer EV Police Pursuit Vehicle Electrified Law Enforcement, Qualified vehicles purchased before 2023 may be eligible for a similar tax credit of up to $7,500. Not be claimed as a dependent on another person’s tax return.

Source: www.carexpert.com.au

Source: www.carexpert.com.au

2024 Chevrolet Equinox EV revealed CarExpert, Other important things about the ev tax credit. Not be the original owner.

Source: www.greencarreports.com

Source: www.greencarreports.com

Biden proposing pointofsale incentives, affordable EVs made in America, How to claim the ev tax credit in 2024 because dealerships are now able to offer the tax credit as a discount off the sticker price, there aren't many steps for the. The rules why does the ev tax credit keep changing?

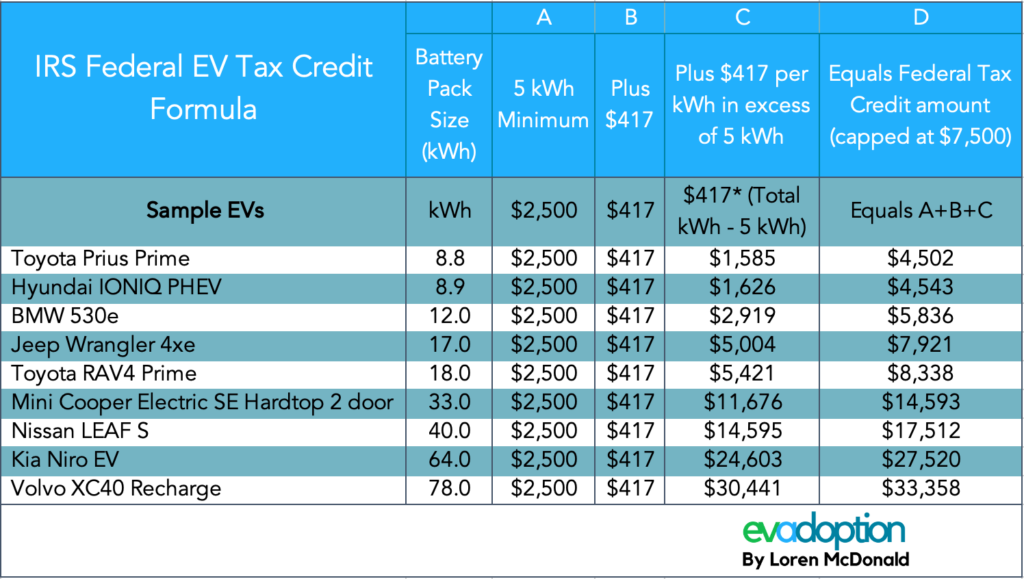

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, The revised ev tax credit for consumers, passed as part of 2022’s inflation reduction act, introduced a whole bunch of extra stipulations to the longstanding. Those ev tax credit rules address requirements for critical mineral and battery.

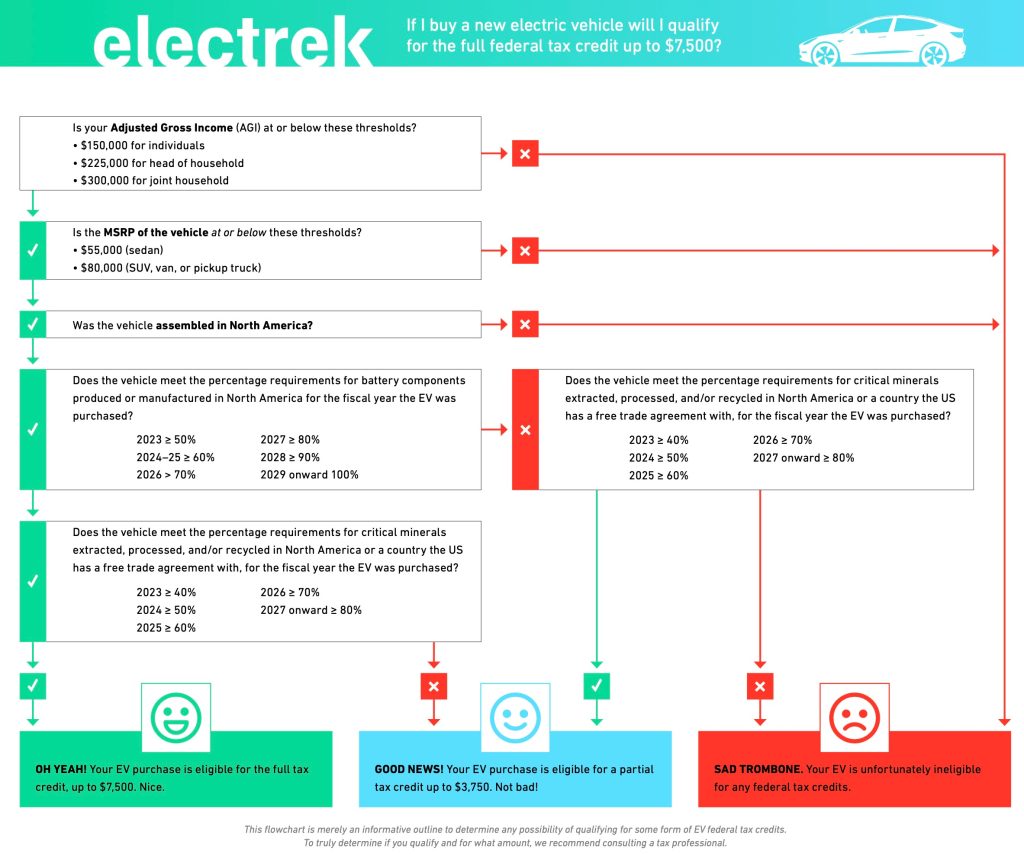

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, Here’s which cars are eligible. It's worth 30% of the sales price,.

Source: www.youtube.com

Source: www.youtube.com

The 2023 EV Tax Credit Changes Are A Big Deal Who Keeps It & Who, Not be the original owner. Or follow us on google news!

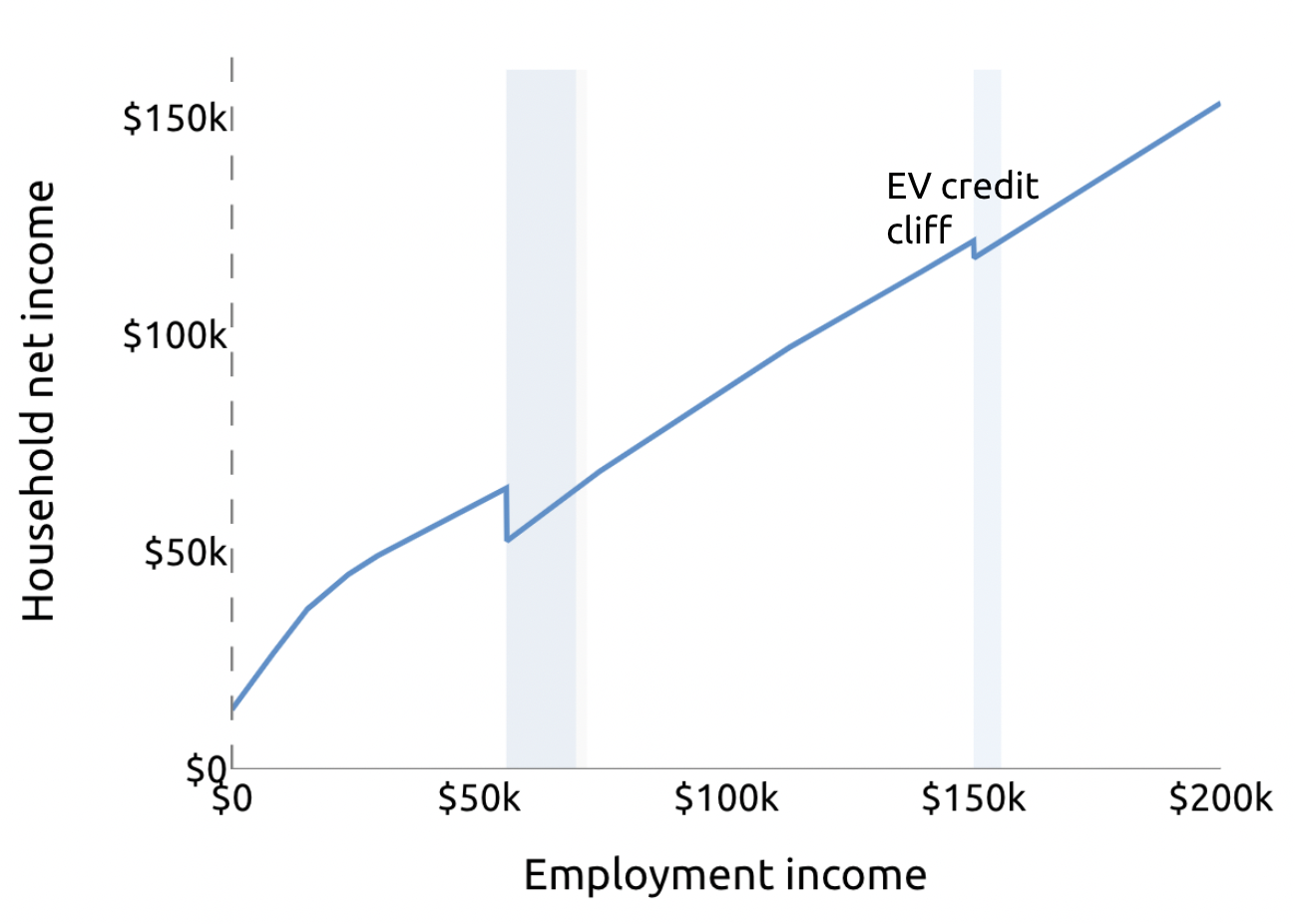

Source: www.ubicenter.org

Source: www.ubicenter.org

The Inflation Reduction Act discourages electric vehicle buyers from, The rules why does the ev tax credit keep changing? Or follow us on google news!

How To Claim The Ev Tax Credit In 2024 Because Dealerships Are Now Able To Offer The Tax Credit As A Discount Off The Sticker Price, There Aren't Many Steps For The.

That's because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there's a tax credit for you too.

Not Have Claimed Another Used Clean Vehicle Credit In The 3 Years.

And if you thought you finally understood how the ev tax credit works, look again.